Investments in Spain

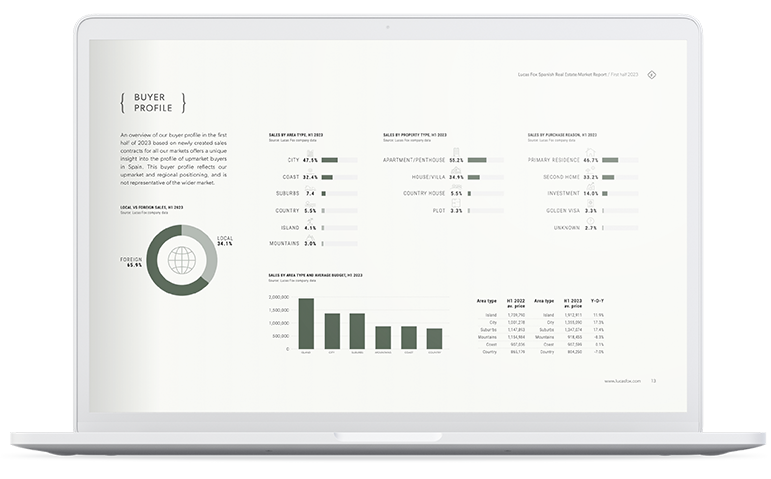

Spain has been recovering well from a challenging 7-year recession during which property prices were hit hard. Midway through 2014 prices bottomed out and, in some regions, properties were listed at prices up to 50% below the peak of 2007. For the last 3 years or so, however, prices have been steadily rising, offering investors enticing opportunities especially in Spain’s key cities, their surrounding areas and desirable coastal regions such as the Costa Brava, Ibiza and Marbella. These areas have recovered relatively quickly compared to the rest of Spain thanks to a combination of factors including strong local economies, better job creation, the second home market and foreign demand. Banks are also lending again and interest rates continue to be low. Not surprisingly, the biggest prices rises have been seen in Barcelona and Madrid, where prices showed an annual growth rate of 18% and 20% respectively at the end of Q3 2017 (Idealista), partly due to price readjustment as well as strong and growing demand for new home residential developments, which is currently outweighing supply.

Compared to most Northern European cities, however, property in Madrid and Barcelona still offers good value for money. But just as in Spain as a whole, these cities have ‘two-speed markets’ where you find that in some areas, prices have only recently levelled out but in other highly desirable areas where demand is high, there have been significant price increases, appropriate to the current market conditions. Circumstances are very different compared to 10 years ago at the start of the recession – the construction industry now represents a much lower proportion of Spain’s GDP, there is more control over risk indicators and, overall, investors are much better informed. Forecasters are therefore not predicting another ‘boom and bust’ scenario.

Looking ahead, we expect there to be normalisation within the market and prices to settle down. Madrid and Barcelona, as is the case in other European capitals and large cities, will always be one step ahead of the rest of the country in terms of prices and in property activity. Rental yields in Spain’s top two cities are also increasingly attractive for investors.

In addition to its growing attractiveness from an investment perspective, Spain will always offer numerous lifestyle benefits, arguably unrivalled elsewhere in the world.